Have you heard of Mama Bear, Stone & Beam, 206 Collective, or Solimo? If you’ve been shopping on Amazon for anything from baby food to mid-century style flower pots, you might have seen these brands. Many customers and businesses who trade on Amazon are not aware that these brands are actually private-label products or exclusive brands that fall under the “Our Brands” wing of Amazon retail. Reports from late 2019 show Amazon has 146 private label brands and 640 Amazon exclusive brands currently operating in every Amazon locale, except Amazon Netherlands, Amazon Brazil, and Amazon Turkey.

Our brands history

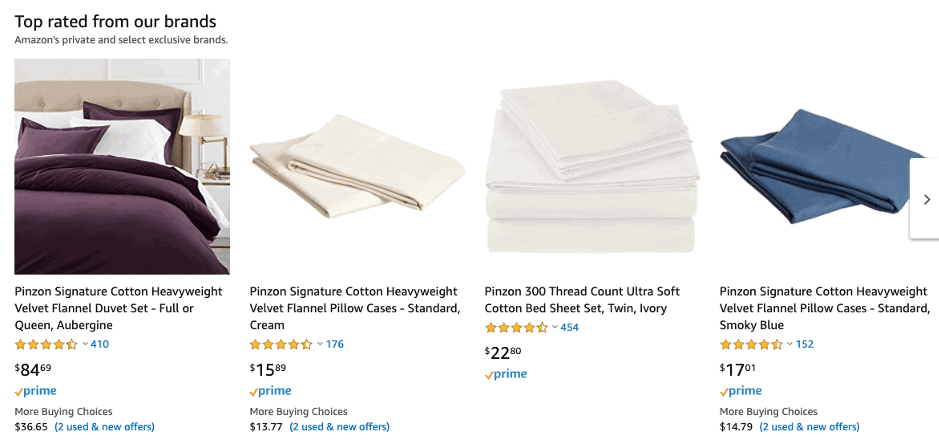

One of Amazon’s most popular and lucrative brands is the private label Pinzon, which began selling textiles and household goods in August 2005 on Amazon.com. AmazonBasics, Amazon’s first in-house brand launched in 2009 selling a range of home goods products. This brand quickly expanded to include tech items, office products, home improvement items, kitchen and bath hardware and more. As of 2017, it was the bestselling private-label brand on Amazon. Amazon Elements, selling household products and diapers emerged in 2014, and other brands breaking out these categories further such as Solimo and Mama Bear followed. Food-specific brands, including Wickedly Prime and Happy Belly followed suit. The Whole Foods acquisition in 2017 also gave Amazon the private-label 365 brand.

As of 2020, the range of brands and exclusives segments into nearly every category, from pet food to women’s dresses.

What this means for brands

Private labels and exclusives have existed for decades in brick and mortar stores, encompassing grocery products, clothes, and more. This is apparent if you step into any grocery or chain store around the globe (think Wal-Mart/Asda, Tesco, Sainsburys, Target, Kroger, etc). With the rise and continued expansion of Amazon, the retail landscape has changed rapidly over the years, with every retailer looking for an edge. Businesses have become proficient at trading under the Amazon umbrella as vendors and sellers (or both), but the rise of Amazon capitalising on their own-brand and private-label products raises controversial questions. First and foremost, how can brands compete on Amazon and WITH Amazon?

The power of Amazon

Like any good retail business, success comes from a number of factors. For example, researching product ideas, finding items with the highest demand, isolating gaps in the market, creating quality products with the correct price point, gaining popularity through exposure, advertising and reviews, good customer service and response. Amazon, with more than 150 million Prime subscribers and a $1 trillion market valuation as of Q1 2020, can do all of that incredibly effectively.

As a result, politicians and competing businesses have criticized Amazon for its dual role as both a third-party marketplace and as a direct seller of their own private-label goods.

Amazon Research Club and other resources

There are many levers Amazon can pull to perform well, without most customers even realizing a particular brand is associated with Amazon, as opposed to just selling on Amazon. I experienced one example as an Amazon customer myself. I became a member of Amazon’s invite-only program for Prime members, called the Amazon Research Club out of curiosity. Described by Amazon as: “Available to select Prime members, ARC grants participation in a variety of market research studies, product testing, early access to products, as well as information about new product launches. Members who receive an email invitation are invited to complete a qualifying survey before acceptance into the program. ARC periodically sends these invitations throughout the year.”

Through a few years of this program, I was able to sample Amazon’s own-brand products and provide feedback about them. I have been sent paper towels, marketed under the Presto brand and answer questions about what type of applesauce I might purchase for my family. I have received dog food trial packs and responded to surveys about sweatshirts and kids’ socks. Earlier this month, I responded to a survey from ARC solely about Trader Joe’s brand mint chip ice cream. What is Amazon doing with that information? Time will tell. I can say that every Amazon own-brand product I have seen rivals or betters the quality of competitor brands.

This is merely one example of the power of Amazon. The amount of customer data and the sheer reach of their platform is likely an enormous benefit that small businesses simply won’t have. Amazon is also able to put their products front and center, running ads and prioritizing them in search results, detail page suggestions, and more.

How are these brands performing?

With these factors and legitimate concerns in mind, brands may be quick to overestimate the success of these ventures. Some of the most successful brands contain “Amazon” in their brand name, such as AmazonBasics or Amazon Essentials. These brands cover a wide range of items, serving to fill gaps for people searching for needs-based, generic items, such as “batteries” or “women’s underwear.” When customers see an Amazon Essentials-brand item at the top of their results, with likely hundreds of good reviews, it makes sense that these items sell well and continue to accelerate. But what about other categories?

While 640 exclusive brands and nearly 150 private label brands sounds like a lot, a Marketplace Pulse analysis found that almost half of the brands analyzed (encompassing almost 10,000 individual items) were in clothing, with a large share of that being women’s clothing. According to this same report, sales from Amazon's private-label brands were under $1 billion last year. While that may seem massive in isolation, it was just a fraction of the $122.9 billion Amazon raked in from direct online retail sales that same period. What does Amazon have to say about it?

"Private label products are a common retail practice, and Amazon's private label products are only about 1% of our total sales. This is far less than other retailers, many of whom have private label products that represent 25% or more of their sales," Amazon said in an April 2019 statement. This was in response to US Senator Elizabeth Warren’s criticism that Amazon is in a position to tilt the online marketplace in its own favor.

Amazon also said that it limits and protects the use of customer data. "Amazon uses data about individual sellers only to support them or enhance or protect our customers' experience. We prohibit the use of individual sellers' data to compete with them through our first-party offerings, including through our private label products."

Amazon is a leading retailer throughout the globe, but Amazon also has many income sources beyond retail. For comparison, in Q4 2019, AWS generated cloud computing and hosting revenues of $9.96 billion. Yet even though private label and own-brand products are a small percentage of Amazon’s overall business, they are still potentially huge disruptors in the businesses they touch, even with comparatively little investment in terms of Amazon’s total business. Many of these private label products and own brands are still in their infancy, leaving us to wonder how they’ll perform as Amazon continues to expand and grow.

Where does this leave brands on Amazon?

Taking into consideration Amazon’s results and position in the marketplace, vendors and sellers might wonder how to pivot their business for continued growth and success against such factors. Especially when Amazon has even been blamed for copying best-selling products. Should businesses shift to create products to sell to Amazon, rather than on Amazon? There are a lot of questions, and not many tidy answers.

It’s important to remember that direct copies like that are rare and likely over emphasized. The data compels us to believe that in a sea of millions of products, the Amazon own-brand super successes are not as common or as focused as you might believe. As one report details, Amazon is good at creating generic products, not brands. Amazon’s product launches meet areas and categories that are already underserved, rather than focusing on unseating current bestsellers or categories rife with competition. With its business spread over so many priorities, Amazon will likely invest in the most profitable ones, when it comes to logistics and technology growth.

Finally, like all tactics, strategies, and plans when it comes to selling on Amazon, there is no one-size-fits all approach. Have an idea or approach you’d like to run by us? eCommerce Nurse can help with personal proposals and a customized approach.